How to Get Paid Faster as a UK Tradesperson: 7 Proven Strategies

If you're a UK tradesperson, you know the frustration all too well. You've completed the job, done excellent work, and now you're waiting. And waiting. And waiting for payment.

You're not alone. According to recent research, late payments affect over 50% of UK small businesses, with tradespeople hit particularly hard. The average tradesperson spends over 50 hours per year chasing overdue invoices — that's more than a full working week lost to admin instead of earning.

But here's the good news: there are proven strategies that can dramatically reduce payment delays and improve your cash flow. In this comprehensive guide, we'll walk through seven practical approaches that successful tradespeople use to get paid faster.

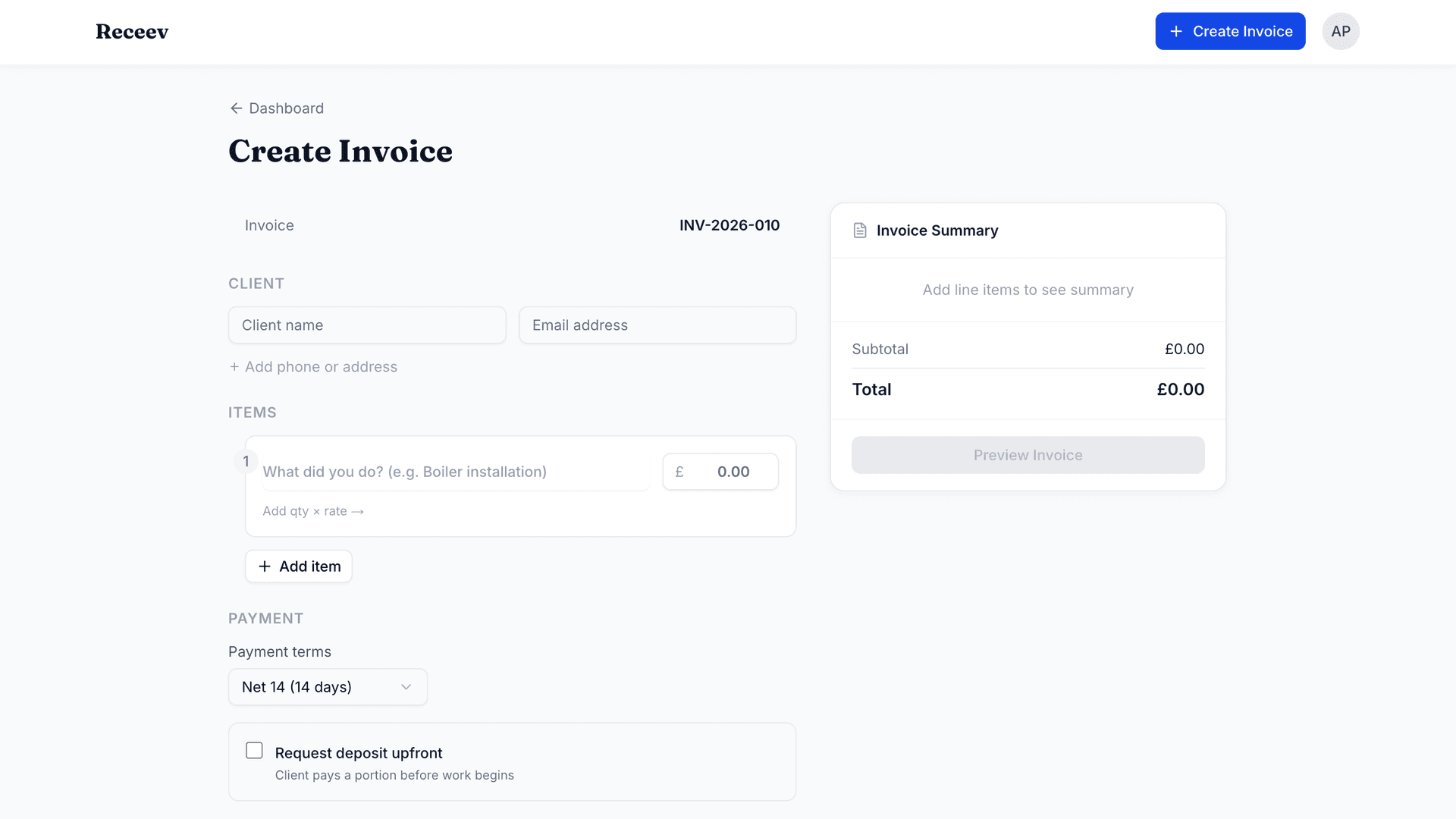

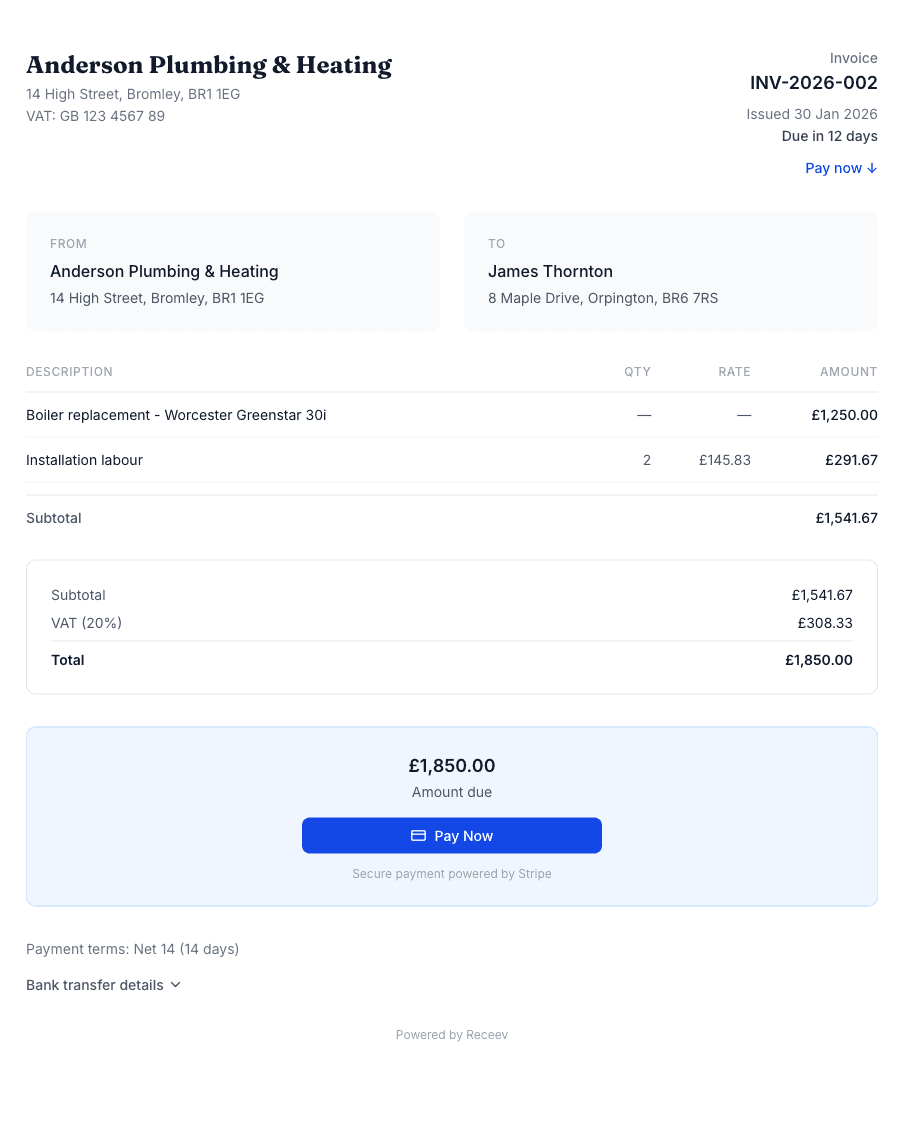

1. Create Professional, Clear Invoices

The foundation of getting paid quickly is a professional invoice that leaves no room for confusion. A well-structured invoice not only looks more credible but also makes it easier for clients to pay promptly.

What every invoice should include:

- Your business details: Trading name, address, contact information, and any relevant registration numbers

- Client details: Full name and address of the person or company being invoiced

- Unique invoice number: A sequential numbering system helps both you and your client track payments

- Clear description of work: Itemised list of services performed and materials used

- Dates: When the work was completed and when payment is due

- Total amount due: Prominently displayed with VAT breakdown if applicable

- Payment methods: How can they pay you?

Many tradespeople underestimate how much a professional invoice impacts payment speed. A scrappy handwritten note or basic Word document doesn't command the same respect as a polished, branded invoice. It also makes you appear more established and trustworthy.

Common invoice mistakes to avoid:

- Vague descriptions like "plumbing work" instead of specific tasks completed

- Missing contact details or payment information

- No clear due date or payment terms

- Sending invoices late, days or weeks after completing the job

The moment you finish a job is when the client is happiest with your work. That's the perfect time to send your invoice — ideally before you leave the site or within hours of completion.

2. Set Clear Payment Terms Upfront

One of the biggest causes of payment delays is unclear expectations. If you haven't explicitly stated when payment is due, clients may assume they have longer than you intended — or simply push payment to the bottom of their to-do list.

Establishing your payment terms:

Before starting any job, clearly communicate:

- When payment is expected: "Payment due upon completion" or "Payment due within 7 days of invoice"

- Accepted payment methods: Card, bank transfer, cash, etc.

- Late payment policy: What happens if they don't pay on time

Many successful tradespeople now use shorter payment windows. While 30-day terms were once standard, many are moving to 7-14 day terms, or even payment upon completion for smaller jobs.

Put it in writing:

Include your payment terms in:

- Your initial quote or estimate

- Any written agreements or contracts

- The invoice itself

- Follow-up communications

When payment terms are agreed upfront, clients can't claim they weren't aware. It also sets a professional tone that indicates you take your business seriously.

3. Embed Payment Links Directly in Your Invoices

Here's a game-changer that many tradespeople don't know about: embedded payment links. Instead of sending an invoice and waiting for the client to figure out how to pay you, you include a link that lets them pay immediately.

Why embedded payments work:

Traditional payment requires the client to:

- Receive your invoice

- Find your bank details

- Log into their banking app

- Manually enter your details

- Type in the amount

- Submit the payment

With an embedded payment link, they:

- Receive your invoice

- Click "Pay Now"

- Complete payment

That's it. By removing friction, you dramatically increase the likelihood of immediate payment. Many tradespeople report that clients pay within minutes of receiving an invoice with an embedded payment link — compared to days or weeks with traditional invoicing.

Benefits beyond speed:

- Reduced admin: No more chasing bank transfers or matching mysterious payments to invoices

- Professional appearance: Shows clients you run a modern, efficient business

- Lower error rate: No risk of clients entering wrong bank details

- Automatic confirmation: Both you and the client receive instant notification when payment is complete

4. Use Automated Payment Reminders

Chasing payments is tedious, uncomfortable, and time-consuming. Many tradespeople put off sending reminders because it feels awkward, but this only makes the problem worse.

The solution? Automated reminders that take the emotion out of the process.

How automated reminders help:

- Consistency: Reminders go out on schedule, every time, without you having to remember

- Professionalism: Automated messages feel less personal than you calling to chase — which actually makes clients more likely to respond

- Escalation: You can set up a series of increasingly urgent reminders

- Time savings: No more drafting emails or making awkward phone calls

A typical reminder sequence:

- Day of invoice: Invoice sent with payment due date

- Day before due date: Friendly reminder that payment is due tomorrow

- Due date: Notification that payment is due today

- 3 days overdue: First follow-up reminder

- 7 days overdue: Second reminder with firmer tone

- 14 days overdue: Final notice before escalation

Most clients pay after just one or two reminders. The key is having a system that sends these automatically, so nothing falls through the cracks.

5. Request Deposits or Stage Payments

For larger jobs, waiting until completion to receive any payment is risky. Materials costs, time investment, and the chance of non-payment all increase with project size.

When to request deposits:

- Large projects: Any job over a certain value (many tradespeople set this at £500-£1,000)

- Material-heavy jobs: Where you need to purchase supplies upfront

- New clients: Where you don't have an established payment history

- Long-duration projects: Where you'll be working for multiple days or weeks

Typical deposit structures:

- 50% upfront, 50% on completion: Common for medium-sized jobs

- 30% deposit, 40% midway, 30% on completion: For larger projects

- Material costs upfront, labour on completion: Ensures you're never out of pocket for supplies

Don't feel awkward about requesting deposits. Most clients understand this is standard practice, and those who refuse are often the ones who would cause payment problems anyway.

6. Offer Multiple Payment Options

The easier you make it to pay, the faster you'll get paid. Some clients prefer bank transfer, others like to pay by card, and some still want to pay cash.

Payment methods to consider:

- Card payments (debit and credit): Most convenient for clients, funds clear quickly

- Bank transfer: Traditional but requires more steps from the client

- Cash: Still preferred by some, but creates record-keeping challenges

- Digital wallets: Apple Pay, Google Pay — increasingly popular

The card payment advantage:

While bank transfers have been the default for many tradespeople, card payments offer significant advantages:

- Instant processing: No waiting for bank transfers to clear

- Convenience: Clients can pay from their phone in seconds

- Security: Protected by card network fraud prevention

- Record keeping: Automatic transaction records for both parties

Yes, card payments involve processing fees (typically 1.5-3%), but many tradespeople find this cost is offset by faster payments and reduced admin time.

7. Build Strong Client Relationships

Finally, never underestimate the power of good relationships. Clients who trust and respect you are far more likely to pay promptly.

Relationship-building tips:

- Communicate throughout the job: Keep clients informed of progress, any issues, and expected completion

- Deliver quality work: This seems obvious, but clients who are happy with the work are more motivated to pay quickly

- Be professional and reliable: Show up when you say you will, and do what you promised

- Follow up after completion: A quick message checking they're happy creates goodwill

Address issues proactively:

If a client has a concern about your work, address it immediately — even if you think the concern is unfounded. Unresolved disputes are a common cause of delayed payments. A client who feels heard and respected will pay faster than one who feels ignored.

Putting It All Together

Getting paid faster isn't about any single tactic — it's about building a system that removes friction and sets clear expectations at every stage.

Your action plan:

- Upgrade your invoicing: Create professional, detailed invoices that you send immediately after completing work

- Set expectations early: Communicate payment terms before starting any job

- Make payment easy: Use embedded payment links so clients can pay with a single click

- Automate follow-ups: Set up automatic reminders so nothing falls through the cracks

- Protect your cash flow: Request deposits for larger jobs

- Offer flexibility: Accept multiple payment methods to suit different clients

- Maintain relationships: Great service leads to prompt payment

Implementing these strategies won't eliminate late payments entirely — some clients will always be slow payers. But you can dramatically reduce the frequency and duration of payment delays, keeping your cash flow healthy and freeing up your time for actual work.

Ready to transform how you get paid? The tools exist to make late payments a thing of the past. The question is whether you're ready to use them.